omaha ne sales tax rate 2019

This rate includes any state county city and local sales taxes. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville.

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

. The Nebraska state sales and use tax rate is 55 055. The latest sales tax rate for Lincoln NE. Counties and cities can charge an.

425 lower than the maximum sales tax in AR. There is no applicable city. This is the total of state county and city sales tax rates.

Several local sales and use tax rate changes will take effect in Nebraska on July. More are slated for April 1 2019. The local sales tax rate in Omaha Nebraska is 7 as of May 2022.

AP Republican gubernatorial challenger Tim James on Wednesday called for a. There is no applicable city tax. 2020 rates included for use while preparing your income tax deduction.

Omaha NE Sales Tax Rate. You can print a 8 sales tax table here. Omaha collects the maximum legal local sales tax.

2020 rates included for use while preparing your income tax deduction. Iowas is 6 percent. May 26 2019.

Ad Lookup Sales Tax Rates For Free. The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax. Nebraskas sales tax rate is 55 percent.

This is the total of state county and city sales tax rates. Nineteen major cities now have combined rates of 9 percent or higher. Interactive Tax Map Unlimited Use.

January 2019 sales tax changes. The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. Several local sales and use tax rate changes took effect in Nebraska on January 1 2019.

Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska state sales and use tax rate is 55 055.

What is the sales tax rate in Omaha Nebraska. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate. New local sales and use tax.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. There are no changes to local sales and use tax rates that are effective July 1 2022. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. This rate includes any state county city and local sales taxes. The current total local sales tax rate in Omaha.

State Tax Rates. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Groceries are exempt from the Nebraska sales tax.

The 775 sales tax rate in Omaha consists of 65 Arkansas state sales tax and 125 Boone County sales tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local. Twenty-five major cities saw an increase of 025 percentage.

15 combined rate of 7. Effective April 1 2022 the city of. The latest sales tax rate for Omaha NE.

What is the sales tax rate in Omaha Georgia. Sales Tax Rate Changes in Major Cities. However as a result of an affirmative.

The following sales and use tax rate changes will take effect in Nebraska on January 1 2017. Rates include state county and city taxes. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

The latest sales tax rates for cities in Nebraska NE state. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Omaha Georgia is 8.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019.

Sales Taxes In The United States Wikiwand

New Ag Census Shows Disparities In Property Taxes By State

Sales Taxes In The United States Wikiwand

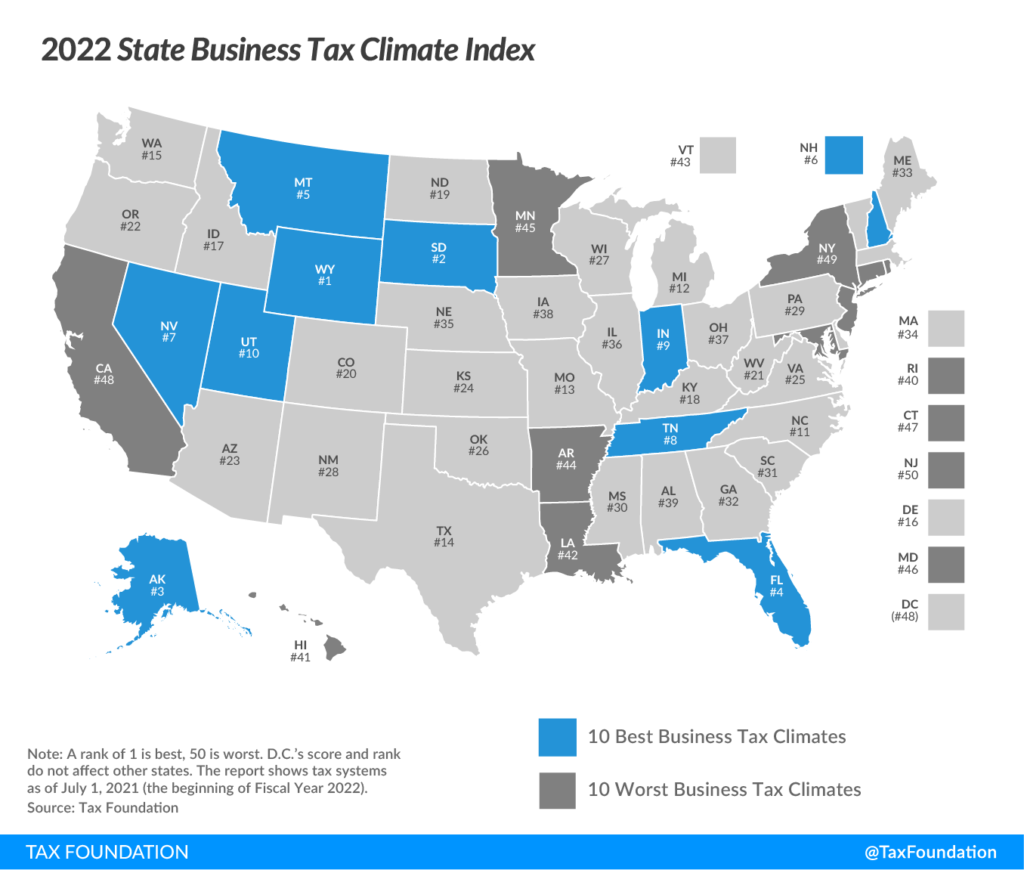

Nebraska Drops To 35th In National Tax Ranking

Sales Taxes In The United States Wikiwand

How To Avoid Estate Taxes With A Trust

These Are The Best And Worst States For Taxes In 2019

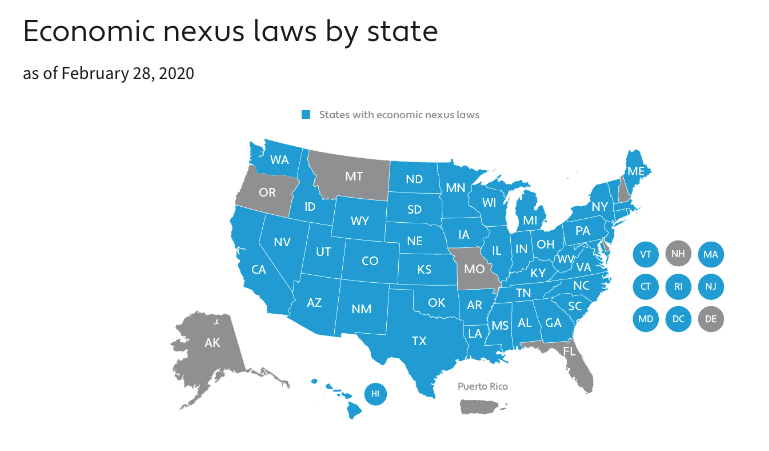

Amazon Sales Tax For Sellers In 2021

Sales Tax Rates In Major Cities Tax Data Tax Foundation